Our Real Estate Investment Strategy

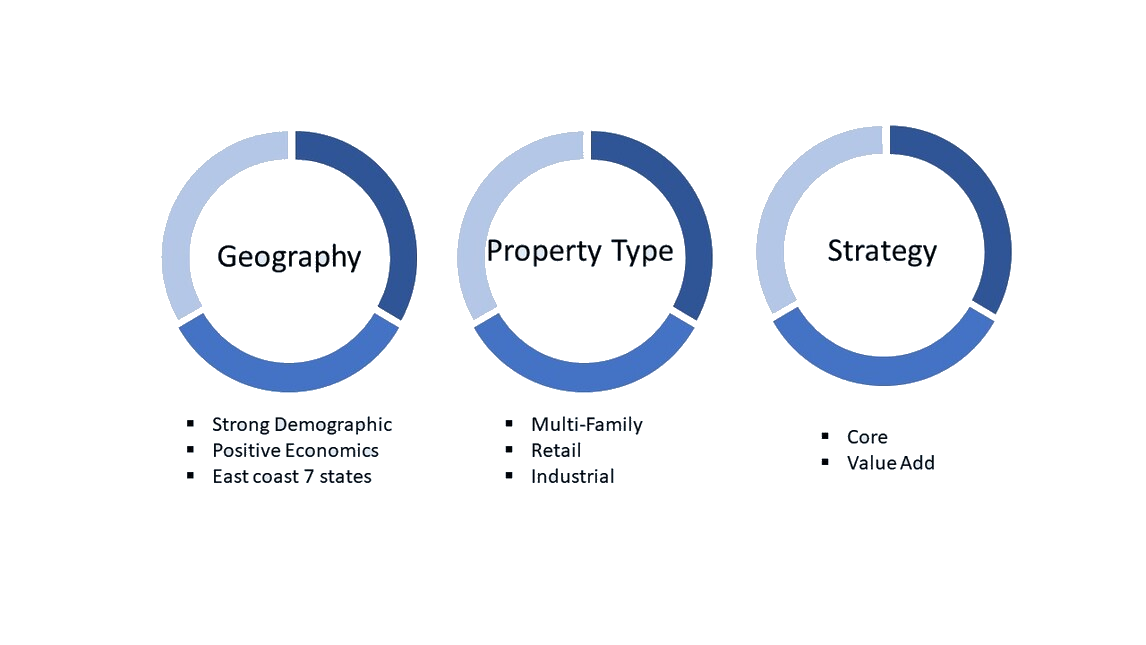

Diversification is used to improve the stability and return potential of our investment portfolio by reducing the risk of loss. Our real estate investments diversify across 3 dimensions: geography, property type, and strategy.

Geography

Real estate markets do not increase and decrease at the same time and they don’t move at the same rate, so geographic diversification is important to lower our risk. We stay in areas with positive demographics and economic fundamentals, while reachable for management efficiencies. Currently, we invest in the following states: NY, NJ, PA, MD, DC, VA, NC, FL.

Property Type

Economic factors and cycles can have varying effects on the different property types. Diversification across property types can help reduce overall real estate portfolio risk and enhance returns. We focus on 3 sectors: multi-family, retail and industrial sectors.

- Multi-Family: Class A or B garden-style, mid-rise or high-rise complexes with 50+ units

- Retail: strip center or free-standing building in the urban dense areas

- Industrial: Distribution buildings in strong locations

Muti-family

Retail

Industrial

Strategy

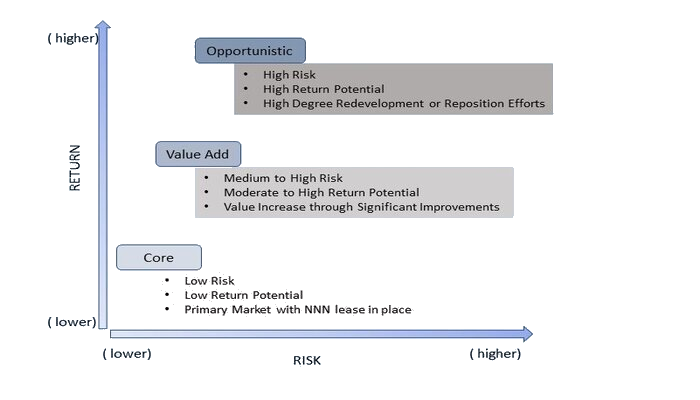

We aim to minimize risk and achieve a higher overall blended return by diversifying across assets at different risk levels. Currently, we focus mainly on the core and value-add segments.

| Core | Value Add | Opportunistic | |

|---|---|---|---|

| Risk | Low | Medium | High |

| Return (IRR) | 7-10% | 10-15% | 15+% |

| Source of Income | Cash Flow Income (70%)

Captial Appreciation (30%) |

Cash Flow Income (50%)

Captial Appreciation (50%) |

Cash Flow Income (30%)

Captial Appreciation (70%) |

| Holding Period | 5+ Years | 3-7 Years | 2-5 Years |

| Building Type | Quality assets with quality tenants and long term lease | Assets with upside potential through refurbishing or releasing | Distressed assets to be developed or re-dispositioned |